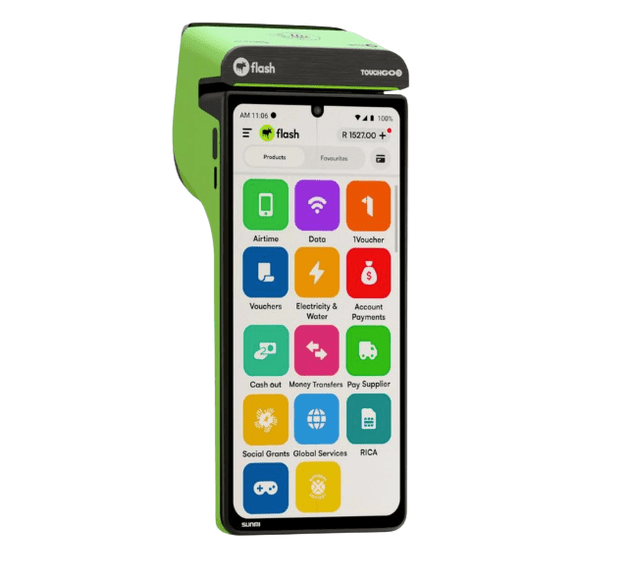

Avansa Card Machines Flash Speed Point Machine

Lost sales from cash-only? Accept cards anywhere with robust, easy Flash Speed Point.

Filter and sort

Avansa’s range of card machines for small businesses in South African, accept card payments anywhere with including iKhokha, Flash, and Yoco. Whether you run a retail shop, restaurant, spaza, or mobile business, our solutions make payments quick, secure, and effortless—empowering growth across South Africa and Southern Africa.

Where can I Get Flash Machine

- Directly from Avansa: Click "Request a Quote" and you will receive a quote in less than 1 hour.

- Our Online Stores: Retail Gear and MoneyCounters.co.za

- Flash machine price

Why Buy Your Payment Terminal from Avansa?

- Top Brands, One Supplier: Access leading payment devices—iKhokha, Flash, and Yoco—all in one place, backed by trusted local support.

- Tailored for SMEs: Solutions for startups, spaza shops, salons, mobile traders, and established businesses.

- Fast, Simple Setup: Get started in minutes—no long contracts, easy SIM connectivity, and nationwide delivery.

-

Affordable & Flexible: Choose devices that match your transaction volumes and budget, with clear, upfront pricing. ikhokha machine price is not the cheapest or best value device on the market anymore.

- Expert Advice: Visit our Johannesburg showroom or get remote assistance to choose the best payment terminal for your business.

- Comprehensive Payment Solutions: Pair with POS stands, safes, paper rolls, and security accessories for a full setup.

Avansa offers a comprehensive range of payment terminals for small businesses in South Africa, featuring top brands like Ikhokha, Flash, and Yoco, trusted across South Africa for secure and efficient payment processing. Our clients regularly share how upgrading to modern card terminals has improved sales, boosted customer satisfaction, and streamlined reconciliation—one independent retailer reported a significant reduction in cash handling and faster transactions after switching to Avansa’s Ikhokha and Yoco machines. With years of expertise in payment solutions, our team offers personalised advice to help you select, set up, and maintain the ideal card machine for your business, ensuring you get the most out of every sale.

Applications

- Retail Stores & Supermarkets

- Restaurants, Cafés & Takeaways

- Spaza Shops & Street Traders

- Salons, Barbers & Beauty Professionals

- Delivery & Mobile Services

- Events & Market Stalls

Grow your small business with reliable card machines from Avansa—your one-stop shop for iKhokha, Flash, and Yoco payment solutions. Contact us for a quote, visit our showroom, or order online today! Click here to buy a card machine now

Expanding Customer Payment Options

Providing customers with a variety of payment options, including credit card payments, is key to accommodating customer preferences and enhancing the overall customer experience.

Boosting Sales and Revenue

Credit card machines often lead to an increase in average transaction values. Customers are more likely to make larger purchases when they can pay with a card.

Enhancing Business Credibility

Having a payment terminal is often seen as a sign of a reputable and stable business, which can help in building trust with customers.

The Advantage of Low-Fee payment terminals in South Africa

Maximising Profit Margins

For small businesses in South Africa, every cent counts. Opting for the cheapest payment terminal with the lowest fees can significantly impact the bottom line, allowing businesses to save on costs and increase profitability.

Comparison of Leading Providers: iKhokha vs. Yoco

Both iKhokha and Yoco are renowned for their competitive fee structures in the South African market. They offer affordable solutions tailored to the needs of South African SMEs, making them popular choices for businesses looking to minimise transaction costs. ikhokha machine price - ikhokha is not the most cost effective machine in South Africa anymore, it is recommended retailers compares all offerings or contact one of our consultants for assistance.

The Process of Acquiring a Card Machine

Factors to Consider When Buying a payment terminal

Businesses should consider factors such as transaction fees, hardware costs, network reliability, and customer support when choosing a payment terminal provider.

Simplifying Business Operations

Modern payment terminals come with features that simplify business management, such as sales tracking, inventory management, and integration with accounting software. Some providers offer small business solutions like: business funding to grow your business, cash advance, sell airtime data, digital wallets and mobile vending.

The Impact of Card Machines on Small Business Management

Streamlining Financial Operations

With features like real-time transaction tracking and simplified accounting processes, card machines can significantly streamline financial management for small businesses.

Providing Business Insights

Advanced payment terminals offer analytics and reporting tools that provide valuable insights into sales patterns and customer behaviour, aiding in informed business decision-making.

A Strategic Investment for South African Businesses

Investing in a credit payment terminal is a strategic move for South African businesses aiming to grow and compete in the modern economy. By choosing options with no rental fees, low transaction rates, and reliable support, businesses can enjoy increased flexibility, profitability, and a competitive edge in the market. Whether it’s through providers like iKhokha and Yoco or other affordable solutions, the right card machine can be a vital tool in the journey of business growth and success.

Frequently Asked Questions

Which card machine is best for my small business?

It depends on your sales volume, location, and business type. Our team can recommend the best fit (looking at factors like: card machine price, card machine rates, pos machine features, connection fees — whether it’s iKhokha, Yoco, or Flash.

Do I need a bank account?

Yes, you’ll need a valid bank account to receive payments from your payment terminal provider.

Can I buy accessories like printer rolls or stands?

Absolutely—Avansa supplies compatible paper rolls, POS stands, and security accessories for all popular models.

Do you offer support and training?

Yes! We provide setup guidance, troubleshooting, and ongoing customer support for all devices.

Can you deliver across Africa?

We deliver and support businesses throughout South Africa and major Southern African countries.

Frequently Asked Questions

What are the best card machines for small businesses in South Africa?

How do card machines like Ikhokha, Flash, and Yoco compare?

Where can I Get Flash Machine?

Where can I buy a card machine for my small business?